This is part four of a four-part series. Read part one or part two or part three.

A closer look at Asset Backed Securities

In our final part of the series, Is private debt ready for recession? Revolution Asset Management’s (Revolution) Senior Portfolio Manager, Dr Simon Petris and Portfolio Manager, Steve Sutinen examine Asset Backed Securities (ABS) investments which are focused on providing funding to established non-bank lenders with strong underwriting processes, high credit quality customers, profitable track records and adequate access to debt funding and equity capital to support their business growth.

Image: Example borrowers in Revolution’s strategy

Image: Example borrowers in Revolution’s strategy

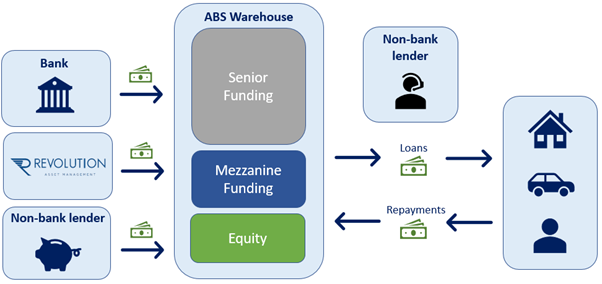

Revolution typically provides funding directly to the non-bank lender’s funding warehouse and not to the nonbank lender themselves. A warehouse is simply a bankruptcy remote special purpose vehicle from which the nonbank lender makes loans to its customers, like residential mortgages or motor vehicle loans. Lending directly to the warehouse ensures that Revolution has security over the portfolio of loans within the warehouse which provides protection from any financial difficulties that the non-bank lender may incur.

Revolution primarily provides mezzanine funding to these private ABS warehouses. The mezzanine funding ranks ahead of the non-bank lender’s own equity but behind a major bank’s senior funding, meaning that losses from any of the underlying loans would first need to deplete the nonbank lender’s equity entirely before any loss can be incurred by the mezzanine investor. This provides a significant layer of protection for Revolution’s invested capital.

Revolution targets its ABS exposures towards consumer loans provided to prime and higher credit quality borrowers with underlying asset security, for example residential mortgages and motor vehicle loans.

Security over physical assets allows the lender to repossess and sell the relevant asset should a borrower become delinquent on their loan.

Source: Revolution Asset Management

Source: Revolution Asset Management

Losing their asset, and potentially incurring a capital loss, acts as a significant deterrent to borrowers defaulting on their loan in the first instance. If a borrower does default, the asset security then also helps to limit any loss on the loan. For example, a residential mortgage which has accumulated equity from the borrower’s initial deposit, loan repayments and house price growth, could be sold at a large discount to the market price and the lender would still not suffer any loss on their loan.

Due diligence

Before committing to any new ABS investment, Revolution conducts intensive on-site due diligence reviewing each non-bank lender’s underwriting processes including customer identification, income verification, borrower repayment capacity, arrears management and collections. Revolution performs a detailed review of individually selected customer loan files to ensure that the originator is prudently providing finance to stronger credit quality borrowers.

Once a non-bank lender’s business model has been assessed, Revolution constructs a detailed cashflow model to analyse significant stress testing scenarios which simulate weakening economic conditions and rising unemployment. These scenarios, which can be many multiples of the ‘stress tests’ which APRA imposes on banks, determine the amount of equity which Revolution requires the non-bank lender to contribute to the warehouse. Given the limited number of suppliers of ABS mezzanine funding in the Australian market, Revolution has a very strong negotiating position to demand adequate equity capital in each transaction to meet its modelled stress scenarios.

Following investment, Revolution receives detailed performance reporting from every private ABS warehouse on a monthly basis. Realtime reporting combined with a strong negotiating position gives Revolution the ability to demand that the non-bank lender take remediating actions, like adding additional equity into the warehouse, at the earliest sign of any deterioration in the underlying loan portfolio.

Attractive defensive returns through the cycle

Investments in ABS transactions are all made on a floating rate basis therefore as market interest rates rise the yield on these investments will also increase. For a warehouse to be able to withstand this increased cost of borrowing, non-bank lenders have the ability to pass through rate increases to the underlying borrowers. Increasing customer interest rates may lead to an increase in customer arrears and potential defaults however Revolution’s stress test modelling gives comfort that any increased defaults would be adequately absorbed by the originators equity.

Where will pressure likely emerge?

Whilst current economic data continues to show strong consumer health with historically low levels of arrears, it is Revolution’s view that the areas that are likely to experience financial pressure in the medium term are:

Lower quality borrowers are likely to experience stretched cashflow from higher living costs and increased mortgage payments which may lead to increased arrears and defaults.

Strong residential property markets in recent years have likely resulted in some borrowers over-extending themselves to buy property at historically high prices. As property markets cool and interest rates increase, marginal borrowers could face unaffordable loan repayments combined with negative equity resulting in losses on forced property sales.

Unemployment in Australia remains at historically low levels however this will rise in a recessionary environment. Increased unemployment will lead to increased consumer lending arrears and defaults particularly for those working in cyclical industries for example retail and hospitality.

The winners

Well capitalised consumer finance lenders with conservative underwriting polices will be the winners in the ABS market. Revolution’s investment process specifically targets ABS originators which will be able to withstand economic turbulence and avoids originators with riskier business models.

Conclusion: An unsettled market brings opportunities for private debt

Globally we are facing a market environment featuring soaring inflation, rising interest rates and significant economic uncertainty.

Throughout this series we have highlighted specific characteristics which make private debt particularly suited to provide investors with protection against these macroeconomic headwinds and deliver attractive risk adjusted return.

Private debt is a floating rate, cash flow generating asset class, meaning that the investment yields will increase in line with interest rates. Private debt provides capital protection through its secured loan structures and Revolution’s asset selection targeting stable, non-cyclical industries should limit the impacts of a looming recessionary environment.

Overall, manager selection and the construction of investment portfolios that remain resilient through more challenging conditions expected over the next 12-18 months, will ensure that investors in private debt strategies will achieve their stated objectives.

Is private debt ready for recession? – a four part series

Missed the previous parts of Is private debt ready for recession? Click the links below to go to:

- Part one – Not all private debt is the same

- Part two – Reaching for resilience as we take a closer look at leveraged loans

- Part three – Considerations when investing in real estate debt

- Part four – A closer look at Asset Backed Securities

For more information on performance and the portfolio of loans or about the Revolution Private Debt strategy, contact us.

This article is for institutional and professional investors only and has been prepared by Revolution Asset Management Pty Ltd ACN 623 140 607 AFSL 507353 (‘Revolution’) who is the appointed investment manager of the Revolution Private Debt Fund I, the Revolution Private Debt Fund II and the Revolution Wholesale Private Debt Fund II (together ‘the Funds’). Channel Investment Management Limited ACN 163 234 240 AFSL 439007 (‘CIML’) is the Trustee and issuer of units for the Funds. Channel Capital Pty Ltd ACN 162 591 568 AR No. 001274413 (‘Channel’) provides investment infrastructure services to Revolution and Channel and is the holding company of CIML. None of CIML, Channel or Revolution, their officers, or employees make any representations or warranties, express or implied as to the accuracy, reliability or completeness of the information, including forecast information, contained in this document and nothing

contained in this document is or shall be relied upon as a promise or representation, whether as to the past or the future. Past performance is not a reliable indication of future performance. All investments contain risk. This information is given in summary form and does not purport to be complete. To the extent that information in this document is considered advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling units in the Funds please note that it does not take into account your particular investment objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, you should seek independent financial advice. For further information and before investing, please read the relevant Information Memorandum available on request.