Market Backdrop

The first half of 2019 ended with extraordinary returns being achieved from most asset classes, which was a continuation from the trend that we saw in the first quarter of 2019. However, the worrying developments are around slowing global growth and persistently low inflation, with many global central banks having started their easing policies, and others in position to act in response to these threats. The key market issues for the second half of 2019 will be in response to the continuation of the US/China trade tensions, a poor corporate earnings season and the US Federal Reserve (the Fed) that has commenced an easing policy in an environment where rates have inverted, and the probability of US recession has increased.

Global bond markets have been indicating a weak economic backdrop for quite some time in all developed markets with long term rates all reducing in unison, however, until recently the global equity markets have achieved near record highs. With the possibility of a US recession increasing there has been a significant rise in volatility and equity markets have pared back recent gains.

Pipeline of Opportunities

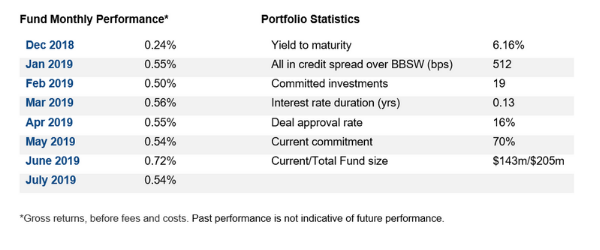

The Revolution Private Debt Fund I (the Fund) is performing well and is currently on track to deliver above its target return, which is cash plus 4% to 5% p.a. (gross of fees and expenses). The objective of the Fund is to achieve this return with low volatility and with the benefit of having security over assets.

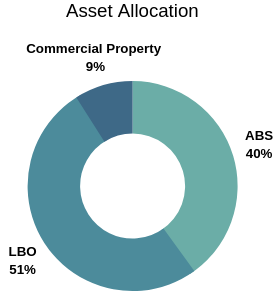

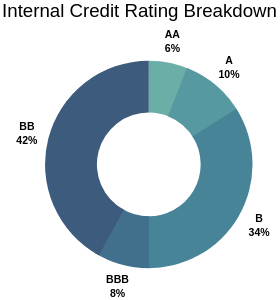

We have previously articulated that the large Australian banks have reduced their appetite for lending in the key focus areas of the Fund, and this thematic was reinforced over the first half of 2019. This is evidenced by a strong pipeline of opportunities for investments that have presented themselves over the last three to six months, that sit well within the risk/return spectrum of the Fund’s investment strategy. We continue to maintain a strong credit discipline based on relative value across the three key focus areas of the Fund being: Australian and NZ Leveraged Loans, Asset Backed Securities (ABS) and Real Estate loans. There are a number of attractive investments that are currently in the advanced pipeline and documentation phase which may result in the Fund deploying greater than 70% of the committed capital of over the next quarter. At this current deployment rate, it is expected that the Fund will be fully invested by year end, which is ahead of its original forecast. Pleasingly, this rate of deployment has been executed whilst maintaining strong credit discipline.

Australian and New Zealand Leveraged Loans

A number of large take-private transactions closed over the quarter, which included the Kohlberg Kravis Roberts (KKR) acquisition of MYOB, Apax Partner’s acquisition of Trade Me in NZ, BGH Capital’s acquisition of Navitas and Brookfield’s acquisition of Healthscope. Additionally, there were a number of refinancing transactions that took place or were in the process of taking place, which typically involve an extension of tenor and/or taking on additional leverage.

Our investment process includes extensive due diligence on each transaction such as detailed analysis of the terms and conditions, the industry and business together with the historical financials to understand the key underlying industry dynamics and the company’s position within that industry, as well as the company’s financial profile. We remain cautious on cyclical industries that exhibit a large amount of peak to trough volatility and those that are susceptible to material external risk factors.

After conducting extensive due diligence, the Fund made three more commitments in the leveraged loan space, supporting KKR’s acquisition of MYOB, Apax Partner’s acquisition of Trade Me and Brookfield’s acquisition of Healthscope – three companies with sound fundamentals and financial profiles, as well as leading market positions.

Asset Backed Securities (ABS)

The Fund targets well established originators of loans that have a demonstrated a long track record in their chosen sub-sector of ABS. For an investment to be approved, an ABS warehouse transaction requires significant alignment through ‘skin in the game’, typically provided via first loss equity from the originator in each transaction.

After extensive research and due diligence, the Fund signed another commitment to an ABS Warehouse with a very well-established non-bank originator, which will commence funding in the third quarter. This new warehouse facility is to target the emerging opportunity in prime and near prime residential mortgages in New Zealand, something that this originator has already successfully executed in Australia. The investment is an Asset Backed Security (ABS) across a combination of A and BBB credit rated notes with a very healthy blended margin of 570 basis points above the swap rate.

We are currently more constructive on New Zealand mortgages than Australian mortgages due to the level of arrears and loan-to-value (LTV) levels generally being lower than Australia. New Zealand households are also less exposed to debt and debt servicing issues, which is demonstrated by the household debt to income level of 125% compared with 190% in Australia.

Real Estate Loans

There have been many opportunities presented to us in the real estate loan sector, however, a vast majority of them have involved construction or development loans or have been backed by residential property. The investment strategy of the Fund excludes these loans as they largely do not generate stable cashflows from the underlying properties with loan repayments being reliant solely on asset sale. During the June 2019 quarter, the Fund made a commitment that meets its stringent investment criteria being a stabilised real estate asset in the non-discretionary retail sector which will be elaborated on in the next quarterly investment report following successful close of the transaction.

Portfolio Summary as at 31 July 2019

This information is provided by the Investment Manager, Revolution Asset Management Pty Ltd ACN 623 839 877 AFSL 507353 (‘Revolution’). Channel Investment Management Limited ACN 163 234 240 AFSL 439007 (‘CIML’) is the Trustee and issuer of units in the Revolution Private Debt Fund I (‘the Fund’). This information is general information only and is not intended to provide advice or a recommendation to investors or potential investors in relation to holding or selling units in the Fund and does not take into account your particular investment objectives, financial situation or needs. Past performance is not indicative of future performance. Before acting on any information you should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, you should seek independent financial advice. For further information, please read the Information Memorandum available on request.